Key Provisions from the One Big Beautiful Bill

President Trump signed the One Big Beautiful Bill (OBBB) into law on July 4, 2025. It is a massive piece of legislation touching on many areas of law. This article will focus on tax provisions that may impact our clients.

Estate Tax

All eyes in the estate planning world have been on the estate tax exemption, which is currently $13.9 million per person. This high exemption was established in the Tax Cuts and Jobs Act (TCJA) of 2017. However, the exemption was set to “sunset” at the end of 2025 – reverting back to $7 million per person. This reduced exemption would have put many of our clients’ estates back into taxable territory. Fortunately, the OBBB increased the exemption to $15 million per person, with annual inflation increases, and made the high exemption permanent. This means that an individual who dies in 2026 can have an estate + lifetime gifts worth up to $15 million without paying any federal estate tax. As a reminder, Montana is a Great Place to Die© – we do not have a state-level estate tax.

Our communications with clients over the last few years have stressed the uncertainty of estate tax provisions, which were set to change this year if no action was taken by Congress. The OBBB has provided some certainty regarding the estate tax landscape for the foreseeable future, and we encourage our high net worth clients to get in touch with their attorney to make sure their planning decisions properly align with the now-permanent rules.

Income Tax

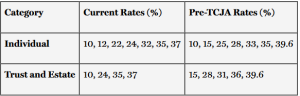

The reduced and simplified tax brackets of the TCJA were made permanent by the OBBB.

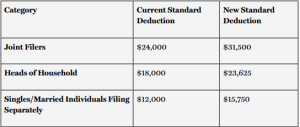

Taxpayers will also see an increase in the basic standard deduction beginning in 2026, which will adjust for inflation each year.

Miscellaneous Tax Provisions

· 529 education accounts can now make tax-exempt distributions for a broader range of educational expenses.

· Taxpayers who do not itemize their deductions (people who take the standard deduction) can now claim a charitable deduction of up to $2,000 per person.

· The child tax credit has been made permanent and increased to a maximum of $2,200.

· The $750,000 mortgage interest deduction limit has been made permanent.

· The itemized deduction for state and local taxes (SALT) has been increased.

· Itemized deductions have been limited for taxpayers in the top bracket – discuss with your accountant if you are a high-bracket taxpayer who itemizes.

· Up to $25,000 per year of tip income is deductible through 2028.

· Up to $12,500 of overtime compensation is deductible through 2028.

· The new “senior deduction” for people aged 65 and older grants an additional $6,000 deductible per person through 2028. Prior to the OBBB, about 46% of seniors owed taxes on their social security benefits. With this change, it is estimated that around 12% of seniors will owe taxes on their benefits.

The attorneys at Montana Estate Lawyers are prepared to discuss the estate tax planning implications of this legislation with our clients. For questions about income tax and related deductions, we advise that you consult with your accountant.